The Client

The ClientOne of the largest construction steel manufacturing company. Its products have been used in some of the country’s largest construction projects.

The Challenges

The ChallengesThe process of bank reconciliation was very labor-intensive, as dealing with a bigger number of account types, payments, time zones and manually matching the transaction would make the process complicated and expose the business to error and financial risks. Hence, the client desired to get rid of the daily manual processing reconciliation and automate the whole process using RPA, thus improving operational efficiency.

Some of the major challenges in automating this process were:

The Objective

The ObjectiveWith a vision to be a leader in the steel industry by producing the best quality products, the client aimed at evolving the steel products in the best possible way and being reliable business partners for their customers and clients. The client dealt with over 30 banks in day-to-day commercial transactions. Bank reconciliation being the most ubiquitous type of process was one of the biggest business challenges being faced by the company, as the process involved a series of steps that were carried out manually. This made the process time-consuming, complex and a tedious task to handle.

Hence, to increase productivity, minimize the labor-intensive and traditional repetitive process and shift the focus to value-driven tasks, there was a need to automate, optimize and streamline the reconciliation process to match the payment details and then reconcile and validate the records.

The Solution

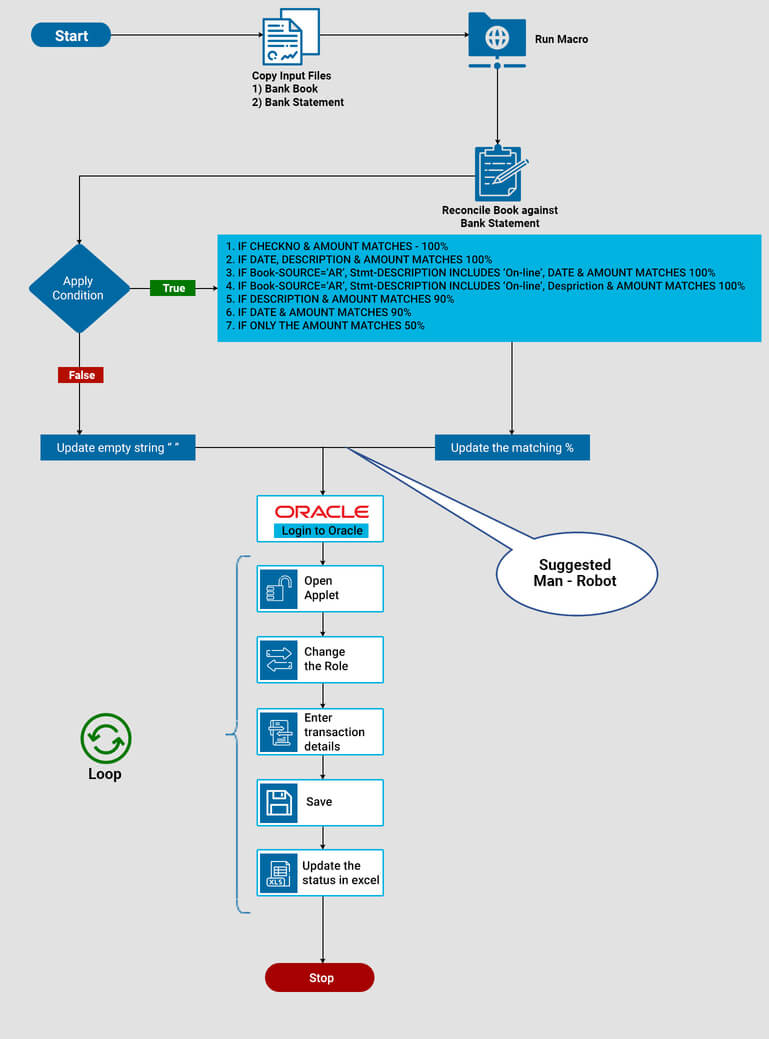

The SolutionOur team started the project by evaluating the process end-to-end in order to come up with an optimized workflow. The RPA based solution was poised to change the way the client performed, the complicated and time-consuming reconciliation process.

The solution involved extracting relevant data and investigating it to spot any discrepancies. A scheduled software bot navigated to a folder, where all monthly bank statements were stored. After navigating, the bot logged in to Oracle E-Business Suite and downloaded the reports.

The next step performed by the bot was the comparison of the bank statement vs Oracle report line-item by line-item and look for any discrepancy or deviation. In case of a mismatch, a record is made in the discrepancy report and the missing transaction was updated in the Oracle system.

The solution automated the numerous manual steps in compliance with the financial standards. In addition, it also helped with exception management and added a security layer in the process. The different discrepancies and huge volume data were managed and fixed efficiently by the bot. The automation saved time and resources, helping the client to focus more on value-driven tasks.

Fig: The Workflow Diagram

The Benefits

The BenefitsUse the form below to get in touch

Hello, I am Aria!

Would you like to know anything in particular? I am happy to assist you.